Minimum Wage

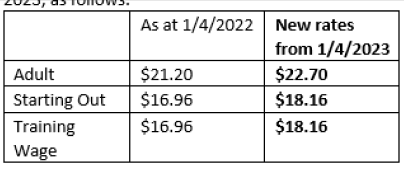

The Government has recently announced increases to the Minimum Wage rates applicable from 1 April 2023, as follows:

A refresher on what each rate includes:

The Adult minimum wage applies to all employees 16 and over who are:

- Not starting-out workers or trainees, or

- Involved in supervising or training other workers. What this means will depend on each individual situation. For example, it would usually include an employee overseeing the performance of another employee, or instructing another employee in the performance of their job; the employee doesn’t have to have direct line management responsibility for other employees. The supervising or training needs to be a part of that person’s job, not just a one-off event.

The Starting-Out wage applies to workers who are:

- 16- and 17-year-old employees who haven’t done six months of continuous employment service with their current employer. After six months with one employer they are not starting-out workers and must be paid the adult minimum wage.

- 18 and 19 year old employees who have been paid one or more social security benefits for six months or more, and who haven’t completed six months’ continuous employment with an employer since they started being paid a benefit.

The Training minimum wage:

- Applies to employees aged 20 years or over whose employment agreement states that they have to do at least 60 credits a year of an industry training programme to become qualified in the area they are working in. Many of these employees will be apprentices (external link). An apprentice has the same minimum rights and protections under employment law as any other employee but may be paid the training wage.

- Doesn’t apply to employees who are being trained at work, for example, by their employer at the start of their employment; it only applies to employees doing an approved industry training programme.

- Doesn’t apply to an employee who is supervising or training other workers. These employees must be paid at least the adult minimum wage.